CONSUMER CHAMPIONS NOUS LAUNCH FREE PERSONAL COST-OF-LIVING FORECAST

Published:

Read Time: 5 mins

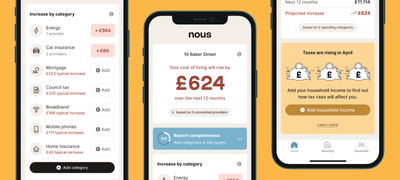

Smart forecast site reveals reveals future household bills to the pound

CONSUMER cost of living champion Nous this week launches a free online service to help millions of families calculate and understand the specific impact that the cost-of-living crisis is having on their personal household spending.

Nous’s revolutionary ‘smart forecast tool’ will work out - on a personalised basis - a family's current household bills, and calculate – in pounds rather than percentages – the effect that every single cost-of-living increase will have on their outgoings.

It predicts the impact of future changes in expenditure to help millions of people get smart about budgeting and save on bills in the face of rising living costs.

Among the household bills Nous takes into account are gas and electricity, satellite and cable TV, broadband, mobile phone, petrol/diesel costs, mortgage, council tax, water bills, and national insurance. Car and home insurance will be added in the coming weeks.

Current predictions are that a family of four can expect their annual household bills to rocket by more than £3,000 in the next 12 months. But the figures can vary dramatically and the impact is different in every household.

The launch comes after research earlier this year showed more than 80 per cent of Brits massively underestimate how much their bills are going to rise and think their personal hike over the 12 months will be just £1,000 – as little as a fifth of the real figure.

The plight of this alarming number of people who remain in the dark is why Nous is committed to providing a service that, as a first step, gives householders a complete and accurate picture of their spending and calculates exactly how much more they’ll be spending in the next year.

Nous founder and CEO Greg Marsh said: “We want to help people understand what the cost-of-living squeeze means to them personally, both now and in the future. And we can show that in real-money terms, rather than confusing averages and percentages.

“Not everyone has the time or know-how to keep track of their bills. But we at Nous believe that knowledge is power, so we can warn people who sign up to our website of upcoming financial pressures and alert them to make savings.

“Nous makes it much simpler for consumers. Keeping track of all the household bills is boring and daunting I know, but this will make it easier. Now is not the time for anyone to bury their head in the sand”.

The Nous service is completely free for anyone who signs up at www.nous.co. And the company promises not to make money by selling on data or receiving commissions when users switch providers. Next year the company plans to launch a subscription service in which they will manage a household’s bills and make sure everyone is on the best deal possible, but the free service will continue.

The idea for Nous.co was hatched back in 2020, well before the cost-of-living crisis developed. It has taken many months of ground-breaking technical development and several millions of pounds of investment to arrive at a ‘superbrain’ dashboard that could revolutionise the way households manage their bills.

Greg Marsh had time on his hands. The entrepreneur – who had developed and sold the successful luxury rental marketplace Onefinestay – was stuck in quarantine with Covid, and his wife was about to give birth to their second child.

Then he noticed he’d been ‘accidentally’ moved onto the wrong British Gas tariff. Faced with paying thousands more than he should, Greg saw red and realised other consumers would also be overpaying for not just gas, but countless utilities: energy, broadband and mobile.

He calculated that with further costs such as TV, insurance, credit cards and mortgages taken into account, the typical UK household busy with children is losing £1,000 a year to these "price bandit" companies.

And so Greg founded Nous as a way to help the millions being taken advantage of to manage their finances most carefully.

He added: “The cost-of-living crisis has made Nous even more timely. Not only do we want to empower people against the tricks of the big providers, it’s now more important than ever that everyone is on the best deal possible.”

"Each household is different, with different providers and types of spend rising at different rates, so we urge people to get smart on exactly how the cost-of-living crisis will impact them.”

You can use Nous’s free dashboard by going to www.nous.co and signing up. It takes just a few minutes and is completely safe and risk free.

Ends

Editors notes

CASE STUDIES

We have access to case studies able to tell their cost-of living stories should you be interested. They include:

Imran Afzal: 45, Scotland - £3,500 increase in cost of living. He says: “I live with my wife and two sons. I was a civil servant for 16 years but had to leave my job due to health conditions. I am just about making ends meet due to all the price rises. I am not able to save because at the end of the month nothing seems to be left over. I am so worried for the future.

Emma Andrews: 40, South London. Emma is a single mum who works as a teaching assistant. Her energy provider went bust and she was put on a new tariff which left her in so much debt that she has had to get a part time cleaning job. She says: “When my energy supply changed me over to a different provider it took so long to organise taking payment it resulted in being over £400 in debt. I cannot afford the repayments as well as the increase. It is so worrying.

Dean Gledson - 41, Hampshire. “The Nous forecast of how much my bills will rise really does worry me. I am 41, a part-time cleaner and a part-time cleaner- but I don’t make any money from that really. I am married and I have two children, a son aged 19 and a daughter aged 10. I’m not sure how we will cope”

Alex Handley: 32, Kent. Alex is so worried about how much money he will have to pay to cover rising bills it has had a large impact on his mental health. He says: “The stress is making me anxious and getting me down. I am concerned about my mental health.”

About Nous

Nous (nous.co) is a new service that helps households get smart and stay vigilant as they face the rising cost of living. Founded in London in 2021 by a team of serial entrepreneurs headed by former venture capitalist and onefinestay founder & CEO Greg Marsh, Nous has raised over £6m seed funding from a who’s who of angels, entrepreneurs and investors, led by Mosaic Ventures. Nous’s mission is to make life simpler and fairer. For more information visit www.nous.co, or follow @get_nous on Twitter.