BCIS and Intelligent AI launch new platform to tackle growing issue of underinsurance

Published:

Read Time: 5 mins

Underinsurance is a persistent problem that leaves property owners vulnerable to significant losses, while insurers and brokers risk legal disputes and miss out on potentially hundreds of millions in premiums.

Ensuring that policyholders have adequate coverage is not just a regulatory requirement, but also a cornerstone of trust and financial security.

To address this growing issue head-on, risk management firm Intelligent AI has partnered with the Building Cost Information Service (BCIS), which has over 60 years of experience in collating and analysing construction costs, to provide a service that automates reinstatement cost assessments at the touch of a button.

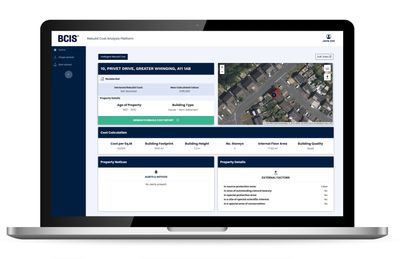

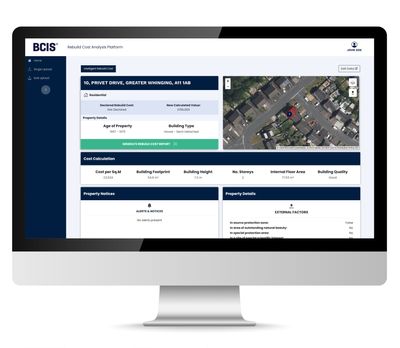

The BCIS Intelligent Rebuild Cost Platform draws from multiple data sources to create rebuild cost reports for residential and commercial properties, including BCIS reinstatement data, planning applications and satellite imagery.

Crucially the platform can report on everything from individual residential properties to multi-billion-pound commercial portfolios, enabling 100% coverage with annual assessments, rather than looking at a proportion on a rolling three or four-year basis. It also enables insurance professionals to explain to customers the context of the cost estimate and why they might need to reconsider the premium.

James Fiske, BCIS CEO, said: “As a data business, we’re used to helping firms to not only access high quality data, but to understand the most appropriate data for them. Sadly, as I’m sure many insurers and brokers experience too, it’s not uncommon to find unreliable sources of data being used to inform sometimes major business decisions.

“This could be simply using market valuations for declared values, or using inappropriate indices, like general inflation, to estimate rebuild costs, and then applying recurrent factors on top. In some larger organisations there can be issues with data management where figures have been passed between teams, have come through an acquisition, or nobody is quite sure what the original source is.”

Using reliable, verified data is crucial to reducing instances of underinsurance and is the driving principle at the heart of the platform.

BCIS reinstatement data alone constitutes more than 1,100 dwelling models and 650 ancillary models, representing a wide range of supporting structures, components, and features. These models are built upon input costs derived from upwards of 12,500 regularly updated supply prices, as well as labour, plant, and specialist rates, in total producing more than four million rebuilding cost permutations.

With automation increasingly being used in the insurance sector to improve efficiencies, Intelligent AI CEO Anthony Peake said the platform, which has been developed using groundbreaking AI tools, together with support from Lloyd’s Lab and leading insurers, is a great example of how technology can free up professionals to better service their customers.

He said: “A desktop assessment carried out to industry standards could take over an hour to complete. The BCIS Intelligent Rebuild Cost Platform can perform the same task, just as accurately and for less cost, in 10 seconds.

“This isn’t about replacing a human’s role in reinstatement assessments. It’s about automating the bulk of cases which are straightforward, while at the same time highlighting the cases where a surveyor does need to go in and make their own assessment.”

Estimates of the prevalence of underinsurance in residential and commercial policies vary, but with the onus on professionals to ensure they have done everything they can to minimise risk, it represents an area of huge concern.

A recent survey commissioned by Aviva[1] found 73% of brokers are worried that some of their clients may be underinsured and they ranked underinsurance second on a list of market challenges they are concerned about. A key aim of the BCIS Intelligent Rebuild Cost Platform is to provide the industry with the tools necessary to communicate the importance of reliable assessments and, in some cases, educate clients.

Peake said: “We’re essentially trying to avert disaster. Whether that's a residential property where a few hundred pounds difference in the premium could save the customer potentially missing out on hundreds of thousands of pounds in a payout, or a commercial portfolio where the declared value is upwards of a billion, it’s about safeguarding people’s homes and livelihoods should the worst happen.

“In a recent test we did with an insurer, analysing a portfolio of 355 commercial properties, we found the reinstatement value to be £1.17bn underinsured, which translated to £2m in lost premiums. More accurate premiums means less risk for everyone involved.”

Underinsurance is not a new issue, but it has been exacerbated in recent years by rampant inflation, which particularly impacted construction materials prices. Annual growth in the ABI/BCIS House Rebuilding Cost Index peaked at 19.4% at the end of 2022, representing a significant hike in the costs associated with rebuilding a property.

Cos Kamasho, BCIS Asset Data Manager, said: “Although inflation has cooled, and we’re not seeing those massive spikes now, there are still lots of external influences that can push up costs.

“Annual growth in the BCIS Labour Cost Index, which tracks movement in trade wage agreements, for example, is at a 20-year high, and there are widely reported skills shortages in the industry. Changes to building regulations can also greatly impact rebuild values as properties have to be rebuilt to the current standard, not what was in place when the property was first built.

“Inflation coming down doesn’t necessarily mean prices have come down. The cost of many materials in construction remain at historic highs, so using an up-to-date data source is vital.”

To find out more about the BCIS Intelligent Rebuild Cost Platform please visit: https://bcis.co.uk/product/bcis-ircp/

For more information about BCIS, please visit: www.bcis.co.uk and for more information on Intelligent AI, please visit: www.intelligentai.co.uk.

Ends

Editors notes

For further information, please contact:

Tom Bushby, Rose Lock, Samantha Clark or Flo Powell

Midnight Communications

01273 666 200

Notes to editors

About BCIS

The Building Cost Information Service (BCIS) is the leading independent provider of construction data to the built environment and insurance sectors. For some 60 years, BCIS has been collecting, collating, analysing, modelling and interpreting cost information to support built environment professionals, helping them provide cost advice, to have confidence in commercial decision-making and to mitigate risk. BCIS was recognised at the Engineering Matters Awards 2024 with The Net Zero Champion Gold Award for its leading role in the development of the Built Environment Carbon Database.

About Intelligent AI

Intelligent AI Limited is a leading technology company specializing in AI, data, and insurance risk management/underwriting technology. With a strong focus on innovation, Intelligent AI Limited creates cutting-edge solutions to empower the insurance industry.

[1] https://connect.avivab2b.co.uk/broker/articles/news/underinsurance-persists--our-latest-broker-barometer-survey-reve/