Embargoed until 06:00 BST, Thursday 20 July

Published:

Read Time: 4 mins

NEW AI TOOL HELPS HOUSEHOLDS SAVE £1,000 ON BILLS

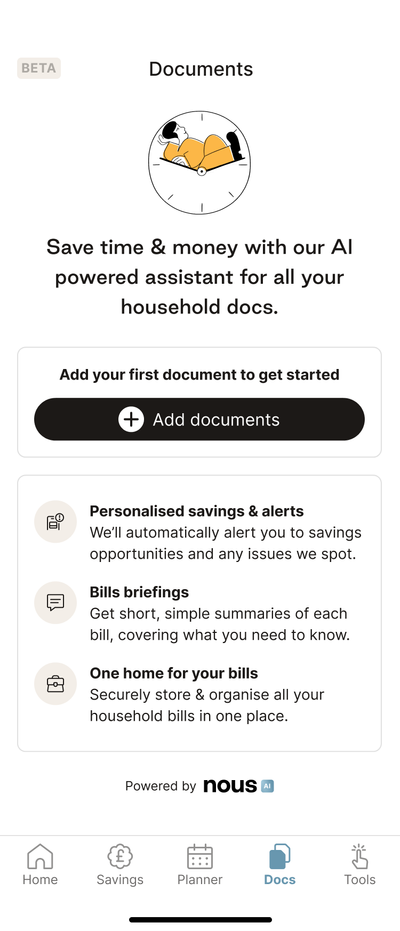

Household money-saving tool Nous.co today launches a ground-breaking AI assistant to help save families £1,000+ a year on their household bills.

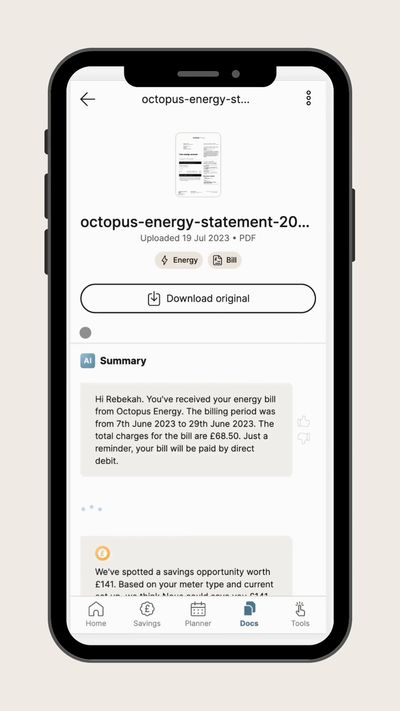

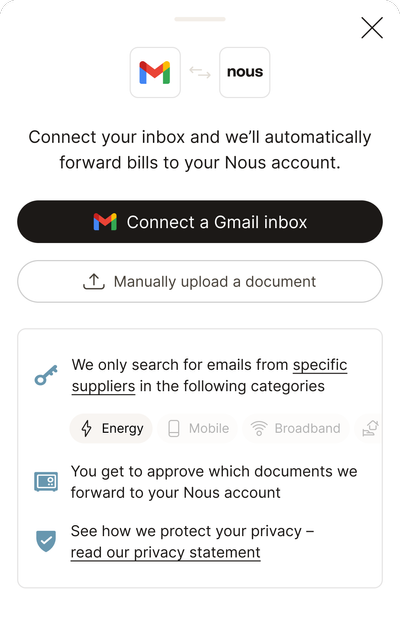

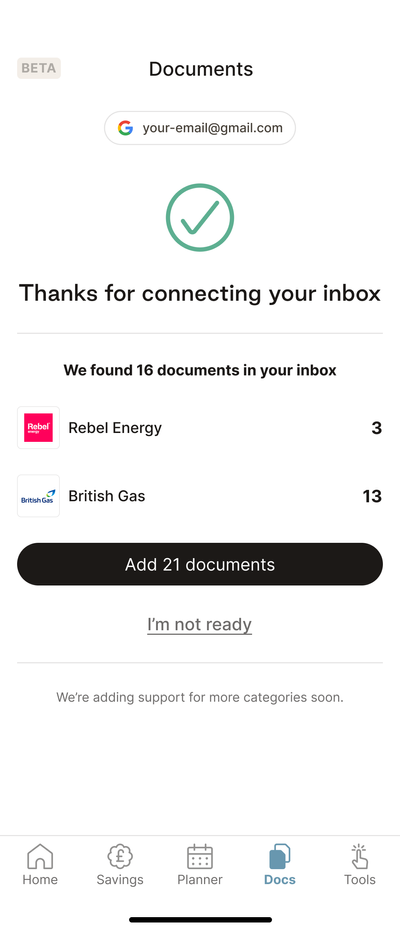

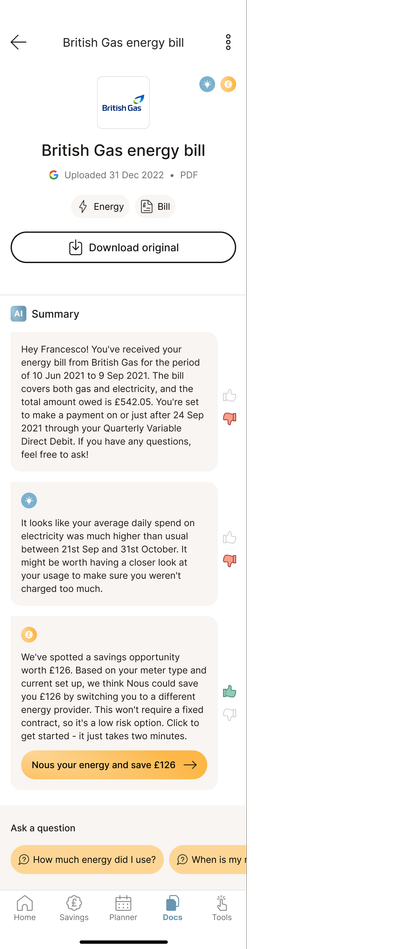

Users can upload a document or connect their inbox to the intelligent assistant to get instant alerts about savings opportunities. The tool uses AI technology to categorise and summarise bills automatically, telling users the information they actually need to know in plain English.

The launch comes as UK households continue to battle the worst cost-of-living crisis in decades. Analysis suggests the typical family in Britain will be £2,100 worse off this year alone, and polling by Ipsos shows that rising prices are the top concern for Britons.

Nous, founded by household finance expert Greg Marsh, is a money-saving service that can save a typical UK household £1,000 per year or more. The company combines the new artificial intelligence tool with the know-how of real-life experts to check bills, alert users to price rises, and move them to fairer deals.

The company is also training the AI to catch attempts that suppliers make to sneak through price hikes or unwelcome surprises such as bills based on estimated usage. The Nous AI learns from feedback, so gets smarter over time the more that people use it.

Alongside saving time and money, the assistant helps to reduce stress and anxiety. Some two thirds of people in the UK report finding it difficult to understand their energy bills, according to Nous research, and just 15% say they always read the small print. In addition, almost 90% of people say they are worried about what will happen to their energy bills this year.

Greg Marsh, co-founder and CEO of Nous, said: “Our new AI-powered intelligent assistant provides instant savings for families reeling from the soaring cost of living.

“We know most people find trawling through every line of their bills boring, confusing, worrying – or all three! It’s such a problem that in reality most of us just don’t do it. Of course companies are all too aware of this, with some using it as an opportunity to bury nasty surprises where they think no one will notice them.

“AI technology is perfectly suited to catching this stuff straight away, saving the need to spend hours each month ensuring you don’t get ripped off.”

The new AI feature, which is included as part of the free tier of Nous membership, currently works with energy bills and will be rolled out in the coming weeks to other categories such as broadband, mobile phone and insurance documents, with instant alerts delivered by email or WhatsApp.

Ends

Editors notes

Covid, a baby and hanging on the telephone: How Nous was born

Greg Marsh had better things to do in March 2020 than wait on hold with British Gas. His wife was due any day with their second child, for starters. But they’d been ‘accidentally’ moved onto a more expensive energy tariff, and now he was into hour number seven trying to fix it.

Being tortured by Coldplay on loop, Greg wondered which other bills they’d been neglecting – broadband, mobile, TV, insurance, mortgage – and how much could it be costing.

By the time he finished wading through them all, Greg had a splitting headache. But at least he’d found thousands of pounds of savings.

In fact, Greg had caught COVID. While he lay in bed shivering, his wife went into labour. At home on his own in the darkness, he waited anxiously for news from the hospital. Then, finally, the phone rang. It was British Gas.

That’s when it hit him. Life’s too important to be battling big companies all alone in the dark. When we’re isolated, the odds are stacked against us. But what if you could find enough people who felt the same, ready to do something about it?

About Nous

Nous is an intelligent assistant that saves people money on their bills and household services including energy, broadband and mobile, finding fair deals for its members and handling all the hassle of changing providers.

The company was founded by a team of experienced entrepreneurs and is headed by household finance expert Greg Marsh, a former VC at Index Ventures and the founder of onefinestay.

Nous keeps track of when contracts end and when new deals emerge, ensuring members always pay fair prices and aren’t hit by loyalty penalties.

Unlike switching and price comparison sites which make their money through commissions and kickbacks, Nous gives any money earned via commissions back to its members in the form of monthly rewards. This means it is able to maintain a strict commitment to neutrality, and also saves Nous members hundreds pounds a year more.

Nous has raised $10million in seed funding from leading entrepreneurs and investors including Tom Blomfield (co-founder of GoCardless & Monzo), Marc Warner (co-founder & CEO of AI pioneer Faculty.ai), Dan Hegarty (founder & CEO of leading digital mortgage company Habito), Eamon Jubbawy (co-founder of fintech unicorn Onfido) and Brent Hoberman (founder of Founders Forum). Mosaic Ventures and Chalfen Ventures also participated.

Nous is a B-Corp pending business, and has used its growing public profile during the cost-of-living crisis to raise awareness of social issues. As part of the company’s commitment to make a positive social impact, it has driven initiatives such as campaigns to increase the uptake of broadband social tariffs, and to crack down on telecoms companies' unfair mid-contract price hikes.

The company was started in 2021 and launched in beta earlier this year.