Power Roll raises £5.8m to scale-up solar film manufacture

Published:

Read Time: 3 mins

Sunderland, UK 11 February 2021 – Power Roll, a developer of a game-changing, ultra-low-cost and lightweight flexible film for energy generation and storage, confirmed today that it has raised a further £3m, which takes total investment in the firm to £5.8m over two funding rounds completed in the last six months.

Equity investors in the round include Indigo 7 Ventures (i7v), Kero Development Partners and RAB Capital. Power Roll also converted £1,250,000 loans into equity as part of the Government’s Future Fund scheme, which was launched to support UK firms through the Coronavirus pandemic, enabling the company to continue to break new ground in technology and innovation.

“The innovative nature of Power Roll’s technology has the capacity to change the outlook of solar installation the world over, not only by a dramatic reduction in cost, but also because it opens up the use of a huge variety of sites and buildings that would not be suited to traditional solar installations,” said Doug Duguid, Chief Executive of i7v. “Power Roll’s core microgroove technology has a number of other applications beyond solar, and as a result they have created a platform product with potentially multiple uses, which is very appealing to us as an investor.”

Roger Doo, Director, Kero Limited said: “We’re delighted to invest in Power Roll. Their technology is truly ground-breaking. We aim to support technology that addresses the environmental challenges facing the world and Power Roll’s unique thin film solar PV is shaping up to make big strides in this area.”

Philip Richards, founder and president of RAB Capital said: “Power Roll's new technology will make solar power dramatically cheaper and available to all worldwide. Our investment has both a strong financial upside and a strong moral dimension; it fits with our investment strategy to make energy capture and storage affordable and available globally.”

“The success of our latest funding round will ensure that we have sufficient capital to meet key milestones as we scale up the technology,” commented Neil Spann, CEO, Power Roll. “As well as opening our roll-to-roll pilot plant for our unique solar film this year, we are developing other applications including capacitors and sensors, and are strengthening our team to support market delivery. We expect to announce further strategic partnerships in due course.”

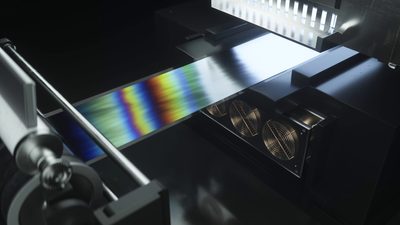

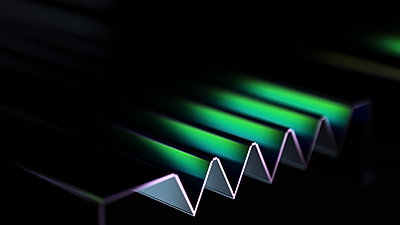

Power Roll’s solar film is on track to deliver the lowest levelised cost of electricity for any solar technology, is 25 times lighter than silicon PV and has a carbon footprint that is 20 times lower. Power Roll’s technology simplifies manufacturing by using high-speed roll-to-roll production processes, which eliminate many costly process steps typical of other solar photovoltaic technologies.

Ends

Editors notes

Power Roll

Power Roll, headquartered in Sunderland, has developed a unique, flexible, light weight solar film capable of producing ultra-low-cost green electricity that is up to 20 times cheaper to make than existing flexible PV. By applying different coatings to its versatile microgroove design, Power Roll can also use the film for energy storage and to manufacture capacitors. Power Roll’s microgroove film is suitable for non-load-bearing rooftops, building integration, transport, portable applications, off-grid projects and IoT sensors.

Twitter: @PowerRollPV

About the Future Fund

The Future Fund will support the UK’s innovative businesses currently affected by Covid-19. These businesses have been unable to access other government business support programmes, such as CBILS, because they are either pre-revenue or pre-profit and typically rely on equity investment. Initially, £250 million was made available by the government for investment through the scheme, to be matched by private investors, with the Treasury making clear the amount could be increased if needed. Due to the popularity of the Fund, more funding is being made available. Developed by the government and delivered by the British Business Bank, the Future Fund launched for applications in May and is open until the end of January 2021.